Contents

ABSTRACT

READ KEY POINTS FROM ALEX FAYETTE'S POV

Why is “anti-decadent” frontier technology such an important category moving forward?

- Plenty of venture dollars are going towards businesses solving “decadent” problems, but one of greatest market opportunities will be frontier technologies that drive bigger, more universal impact. “Defining and analyzing frontier tech opportunities requires mapping new innovations against a growing list of complex problems like supply chain, garbage build up, environmental shocks, geopolitics, input constraints, and a disappearing middle class,” says Fayette.

We’re all resigned to the fact that software will touch every industry and business, but now the question is around what frontier technologies will push change beyond that.

Alex Fayette~quoteblock

- Software has already done a good job eating the world. A new area, or combination of areas, will define the next technological evolution that perforates into every industry and vertical. “I would frame it that software is mid-meal, and you could argue it's almost getting indigestion at this point. We’re all resigned to the fact that software will touch every industry and business, but now the question is around what frontier technologies will push change beyond that,” says Fayette. Whether it’s innovation in biology or intelligent automation or mining technology, “anti-decadent” progress will come from all types of tech that can (and should) be applied in novel ways.

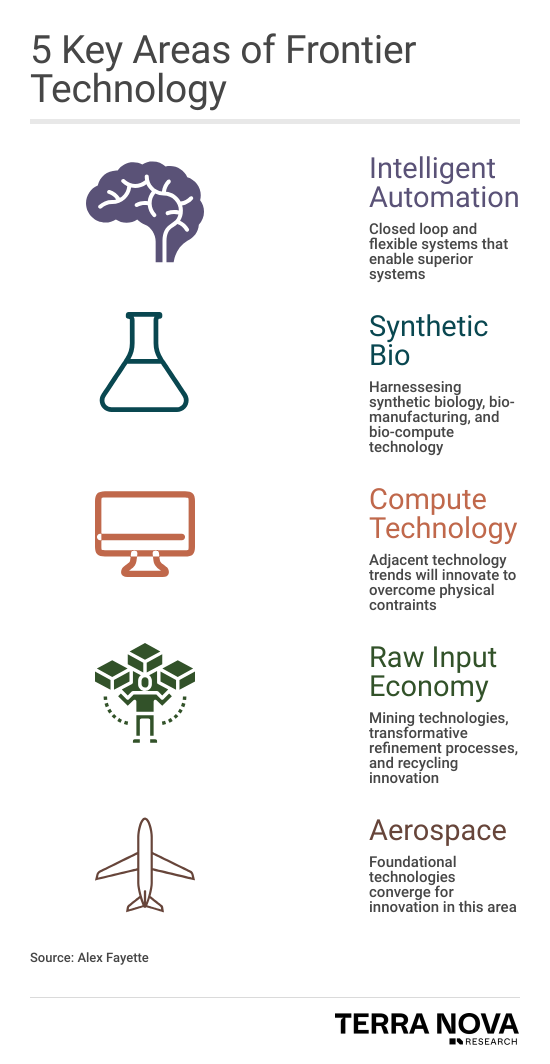

What areas or themes are you most focused on in this category?

- Intelligent automation that enables adaptive, closed-loop systems across numerous industries. “We saw a lot of automation in the 20th century, but it was mostly in open loops and inflexible,” says Fayette. “When we close the loop and use intelligence, there's so much green field out there, far beyond self-driving cars and pick-and-place robots that have run their hype cycles. We’ve invested in several companies in this space and are looking for more,” he says.

- Synthetic biology, bio-manufacturing, bio-compute technology that go beyond pharmaceutical solutions. “There’s a growing consensus that, in the same way that the last century was the age of industry and ultimately an age of information, this will be the century of biology. I don’t disagree,” he says. Bio-manufacturing and bio-compute can offer opportunities for harnessing biology to build materials, to sense the world, and solve problems far beyond drugs.

- Innovation within the raw input economy at the nexus between natural resources, recycling, and the energy value chain. “Whether you're making something, running a service, or growing food, there's this layer of raw inputs, commodities really, going into them all. And there are numerous technologies and innovations that will make the raw input economy more abundant, resilient, and environmentally considerate.” Examples like mining technologies, economically transformative refinement processes, and recycling innovation all offer opportunity for non-linear growth via frontier technology and massive market potential. “We have a huge input problem, whether that's for renewable technology components or energy resources, and frontier technologies in this area can have massive economic impacts.”

What are some of the potential roadblocks?

- Frontier tech is challenging, and moving from idea to application requires more than a great deal of subject-matter expertise. “There aren’t many investors focused on Frontier tech for a reason – it isn’t easy by any means,” says Fayette. “The capital needs for some of these businesses to first get off the ground can seem daunting for some, but the hardest part is actually finding or building the leadership teams that can bridge deep expertise in a new technology, with a clear, decisive commercial vision for how to translate this new technology to a product people want to buy.”

VISUAL: ANTI-DECADENT TECHNOLOGIES

IN THE INVESTOR’S OWN WORDS

A lot of people use the terms deep tech and frontier-tech interchangeably. I split these subjective terms by viewing it as a taxonomy.

To me, deep tech is a whole branch of venture and company building where the technology itself is the company's competitive edge and differential factor. This applies no matter what customers they serve or the business models they use.

Within this category, there are plenty of technologies designed with the purpose of making things 10% better or 10% faster. A lot of semiconductor and materials technology can be like this, the end goal is only a marginal improvement on what's already there. That’s ok though, because these products may still have great impact if at tremendous scale.

To me, frontier technology is a subcategory of deep tech where the underlying technology drives a product to be fundamentally transformative; a 10x change versus 10%. These are technologies that, if economically deployed, would have a non-linear and even revolutionary impact on the current market. I find that these kinds of technologies are currently concentrated in specific areas - automation intelligence, synthetic biology, raw input economics, semiconductors/compute, and aerospace.

Lots of venture dollars are going into innovation projects like making food delivery five minutes faster or helping already-fit people be even moreso. While I think these decadent products can be great, they aren’t going to radically change the world and address our biggest, most-pressing problems. My job as a frontier tech investor is to maniacally dodge all of these solutions that don’t cross that anti-decadence hurdle. My approach is through mapping these new emerging solutions against many of society's biggest problems. If we can find juxtapositions that could have real potential to thrive in chaotic environments as our future becomes increasingly complex in an entropic fashion, that's where we like to strike.

MORE Q&A

Q: How do you approach timing, and where to draw the line between “science projects” and real world business potential?

A: “All of these technologies are a lot easier to work with in the science project stage, and they often stay there for a long time. We love science projects, but it's hard to invest in them. Deciding when these projects are going through this transition requires talking to a lot of experts and having a defined point for how to decide if this is really working. You have to be able to draw the trend line to the end consumer and see how this will reach them.

On top of that, this is also where you have to decide if this technology will really have a non-linear impact. If the technology is being applied to a decedent issue, then I don’t think it's worth pursuing.”

Q: What aspects of this category are often misunderstood?

A: “Frontier technologies and deep tech businesses are really consumer businesses at the end of the day, people just lose their way. People get sidetracked thinking about selling things like biofuel technology, for instance, believing that they are selling to car companies and gas companies and ending there. I don’t believe this. I think you’re really a consumer business, that end consumer is just removed a few steps. You can’t lose track of that core mission, that you’re trying to make fuel more abundant and cheaper and better for the next generation of consumers.”

Frontier technologies and deep tech businesses are really consumer businesses at the end of the day.

Alex Fayette~quoteblock

Q: What is your rebuttal to skepticism around closed-loop systems, and frontier tech in general?

A: “This is most relevant to intelligent automation, and one of the biggest critiques is that you’re “just replacing people with machines”. But, if you consider demographic trends, there's a lot of really critical roles that people simply don’t want to do anymore for the wage it can offer, or that are deemed too risky for valid health and safety reasons. Intelligent closed loop systems will need to automate these processes in some way.

More importantly, I believe that in a large portion of these cases, intelligent automation is actually going to empower and augment people, rather than replace them. There’s been a massive PR failure that is evident in the consensus that Silicon Valley is now coming for the starving artists with new innovations in generative AI. I don’t think that’s the case. These automations aren’t ever going to create the full end-result for creativity. For example, in architecture, there are many architects whose passion is designing beautiful buildings and engaging spaces, but they spend most of their time laying out room for HVAC or creating optimized window designs. What these new technologies will do is automate the time-intensive manual pieces, and people will be able to spend their time making the end-decisions and deciding which generated pieces belong in the end design.”

WHAT ELSE TO WATCH FOR

Semiconductor and compute technology: As semiconductor and compute technology pushes towards asymptotic constraints, adjacent areas of innovation will drive continued growth. “We're not getting transistors to be much smaller here, and so solutions that grow capabilities beyond transistor counts will be very exciting, and are plays that we’re making investments in especially as geopolitics has shocked this industry into a new evolution,” says Fayette.

Aerospace: “A lot of foundational technology improvements happen broadly, but oftentimes, these trends tend to trickle down to converge in aerospace and tee up exciting new innovations with big impacts,” he says.